Dearborn, Mich. (March 27, 2019) How do you stage a Financial Reality Fair that equips high school students with the tools and experience they need to make thoughtful decisions about their careers and finances for the future?

Four Detroit area credit unions and a forward thinking business instructor recently shared the months of planning and collaboration it took to produce a Financial Reality Fair in mid-March for nearly 100 high school students from Dearborn Public Schools at the Michael Berry Career Center in Dearborn Heights.

The idea emerged last spring.

Allan Farhoud, lead business teacher at the Michigan Berry Career Center, took a group of students to participate in a Financial Reality Fair and compete in a Financial Fitness program. It was hosted by the Detroit branch of the Federal Reserve of Chicago during Money Smart Week, an annual week of events to help consumers better manage their perso nal finances.

nal finances.

While at the Federal Reserve branch, Farhoud met and talked with volunteer staff from several credit unions.

“I made sure to get their business cards,” said Farhoud, who described the impact the Financial Reality Fair made on his students. “I wanted to bring this opportunity to our Center so more of our students could benefit.”

Last September, Farhoud started making calls to his credit union contacts to pitch the idea. Four credit unions quickly responded, Catholic Vantage Financial, MemberFocus, Michigan Legacy and Parkside.

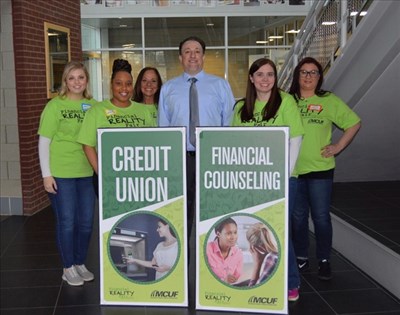

Emma Teller, vice president of operations at Catholic Vantage Financial (CVF), spearheaded the effort with resources and materials provided at no cost by the Michigan Credit Union Foundation.

In October, the credit unions began monthly planning meetings to prepare for the two and a half hour interactive event that would require 35 volunteers to serve as financial counselors and staff 13 booths giving options for students to make financial decisions about their spending.

Farhoud added, “It took a lot of coordination just to pick the right date, place and time, especially when you consider the space needed for 100 students and how to accommodate students’ schedules and credit union volunteers who had to return to work.”

“There was a nice collaboration among us. We’re all small to mid-sized credit unions so it was definitely a joint effort,” said Heather Colonius, chief development officer for Parkside Credit Union, which provided 15 of the 35 volunteers.

Two days in advance of the March event, Teller gave a presentation to the students at the Michael Berry Career Center and passed out budget sheets they would need.

The budget sheets included net monthly incomes for students’ selected careers. In addition, each budget sheet included a hypothetical credit score, student debt, and savings balance.

On the morning of the Financial Reality Fair, students came prepared with their budget sheets and calculators. They were required to visit all 13 booths, which included options for housing, transportation, food, clothing, Internet, and electronics as well as leisure, lifestyle and entertainment.

To keep things running smoothly, volunteers also worked as floaters to help students navigate the booths and to answer questions. One of the floaters, was Jen Galatis, youth program coordinator at Catholic Vantage Financial and an experienced volunteer with four previous fairs.

Galatis said, “I remember one student who said he was broke and had to go back to the booths to change his options.”

After visiting the booths, students met with financial counselors who helped them tally their budget sheets and ensure they were able to live within their projected monthly income. If not, they were sent back to the booths to change their selections.

In some cases with large expenditures for housing, it meant moving back home or finding a roommate.

“I noticed some who were surprised at how little money they had left over,” said Crystal Briley, marketing manager at Michigan Legacy Credit Union. “And, I was also impressed with how extremely polite the students were and interested in what the counselors had to say. They were taking it seriously.”

Other volunteers agreed.

“Volunteering our time and resources to this event was a great investment. In my interactions with students, I could see real-time connections being made about monthly budgeting and understanding how credit scores play into monthly expenses,” said Janet Thompson, president and CEO of Parkside Credit Union. “It’s gratifying to know that our time made an impact on these students’ futures.’”

Farhoud is already looking toward the next year and expanding the program to more students.

The commitment from the credit unions who worked together is also there.

“The road to financial success is through financial literacy,” said Sabrina Fomby, communications director for MemberFocus Credit Union. “Today’s youth are eager to learn about financial literacy. We just have to make the resources available to them.”

For more information about participating credit unions, visit Catholic Vantage Financial at www.mycvf.org, MemberFocus at www.memberfocus.org, Parkside at www.parksidecu.org, and Michigan Legacy at www.MichiganLegacyCU.org.