LAWRENCEVILLE, GA – Peach State Federal Credit Union invests in the communities within their service area through their annual scholarship program, charitable contributions and support of the arts. The credit union donated more than $477,000 in 2018 alone. Peach State’s President/CEO, Marshall Boutwell wanted to ensure that these contributions could continue on a self-sustaining path. “Our merchant interchange income from our VISA® Debit Card program is the perfect solution,” said Boutwell. “For each purchase made with a Peach State VISA® Debit Card, the credit union will donate a nickel from our merchant interchange income toward non-profits, school systems, and the arts in the communities we serve.1”

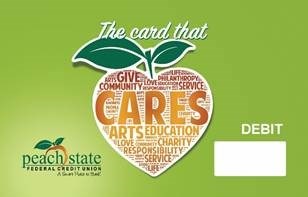

“When it was time to design our new debit card, we wanted to incorporate our brand, our internal core values, who we are, what we do and more importantly ‘why’ we do it,” explained Peach State’s SVP of Marketing, Kristen Patton. “We determined that the following five words summarize what is essentially our ‘why’, our brand, our activities in the community and our mission.”

- Community

- Arts

- Responsibility

- Education

- Service

The credit union’s “why” (Peach State C.A.R.E.S. so that our members and communities may continue to grow.) was derived from these five words and is what sets Peach State apart from other financial institutions.

This enhanced brand message will be incorporated throughout the credit union’s future marketing activities including the website and printed materials. “It is our hope that by sharing our ‘why’, we will increase member loyalty and give others a reason to join,” added Patton.

The new debit card was designed to remind and encourage members to keep their Peach State VISA® Debit Card at the top of their wallet since every purchase will help support our communities. Members will receive the new C.A.R.E.S VISA® Debit Card as their existing debit cards expire; however, all purchases made as of July 1st, 2019 with an existing debit card will contribute to the program. Members do not have to do anything to start participating in the program other than to make purchases and they will not incur any additional charges or fees.

To learn more about Peach State’s Giving Policy and their commitment to their communities, visit www.peachstatefcustories.coop.

About Peach State Federal Credit Union

Peach State is a $517 million credit union that serves more than 60,000 members in Georgia and South Carolina. Operating as a not-for-profit financial cooperative, Peach State’s mission is to provide quality financial services that meet the needs and exceed the expectations of its member-owners. For more information, visit www.peachstatefcu.org.

1 $0.05 per transaction of Peach State Federal Credit Union’s merchant interchange income from our VISA® Debit Card program is used to benefit the communities we serve. Peach State will determine where/how funds are disbursed. This does not affect members’ accounts nor will any member information be disclosed. You will not incur any additional fees or charges from this program. Merchant interchange income is derived from fees that a merchant pays to accept credit/debit card payments. The C.A.R.E.S program may or may not apply to ATM transactions, certain commercial transactions, or other transactions not processed by VISA®.