LANSING, Mich. — LAFCU has awarded three grants that total $7,500 in debt relief in The LAFCU Pathway to Financial Transformation Essay Contest, which was designed to not just help the winners, but to help all who entered.

“We know debt can create stress that negatively affects many areas of a person’s life such as relationships and overall health,” said Shelia Scott, LAFCU community financial education & business development officer. “This contest highlights the value of creating a pathway to financial transformation to achieve financial security, especially for those who have stumbled on their journey.”

Via a one-page essay, entrants focused on their financial situation, assessed it and their accomplishments the past 12 months, and identified how they will continue to work to achieve their financial goals.

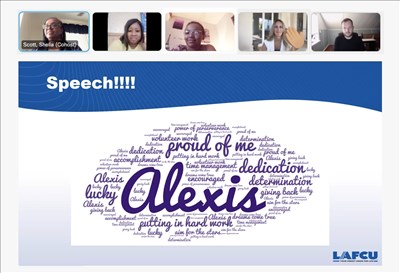

The essays of Candace Collier, Kalamazoo; Alexis Hodges, Lansing; and Lisa Neino, Jackson, stood out.

“They spoke from their heart,” Scott said. “Their essays laid bare the obstacles they have faced and their uphill journeys, yet they continue to make progress one step at a time. They are driven by hope, and they are inspiring.”

The three $2,500 grants were awarded so the winners could pay down outstanding debt. Here are some strategies the winners identified in their essays:

• After bad financial advice dug an entrant into more debt, she learned on her own how to budget and live within her “extremely modest means.”

• After 11 years of on-time payments on an unsecured credit card, an entrant was able to refinance her car at lower interest rate.

• An entrant and her children budgeted an educational road trip through 23 states —their first vacation in more than a decade.

• An entrant increased her credit score by disputing hard inquiries on her credit report and getting them removed.

• An entrant is working to improve what is needed to obtain access to credit because her business cannot grow without it.

This debt-relief program is part of LAFCU’s financial literacy program that helps the Michigan credit union deliver on its desire to help make the communities it serves stronger.

Eligible entrants were those who live, work, worship or attend school in Michigan, the credit union’s geographical service area. They were not required to be a LAFCU member.

Chartered in 1936, LAFCU is a not-for-profit financial cooperative open for membership to anyone who lives, works, worships or attends school in Michigan and to businesses and other entities located in Michigan. The credit union serves 72,000 members and holds over $950 million in assets. It was named a Best Credit Union to Work For in 2020. LAFCU offers a comprehensive range of financial products and services as well as an expanding complement of financial technology solutions. Members enjoy benefits such as low fees, low interest rates on loans, high yields on savings, discounts, knowledgeable employees and nationwide access to feefree

ATMs. A recipient of the national Dora Maxwell Social Responsibility Community Service Award for credit unions, LAFCU enriches the communities it serves by supporting many organizations and causes. To learn more about LAFCU, call 800.748.0228 or visit www.lafcu.com.